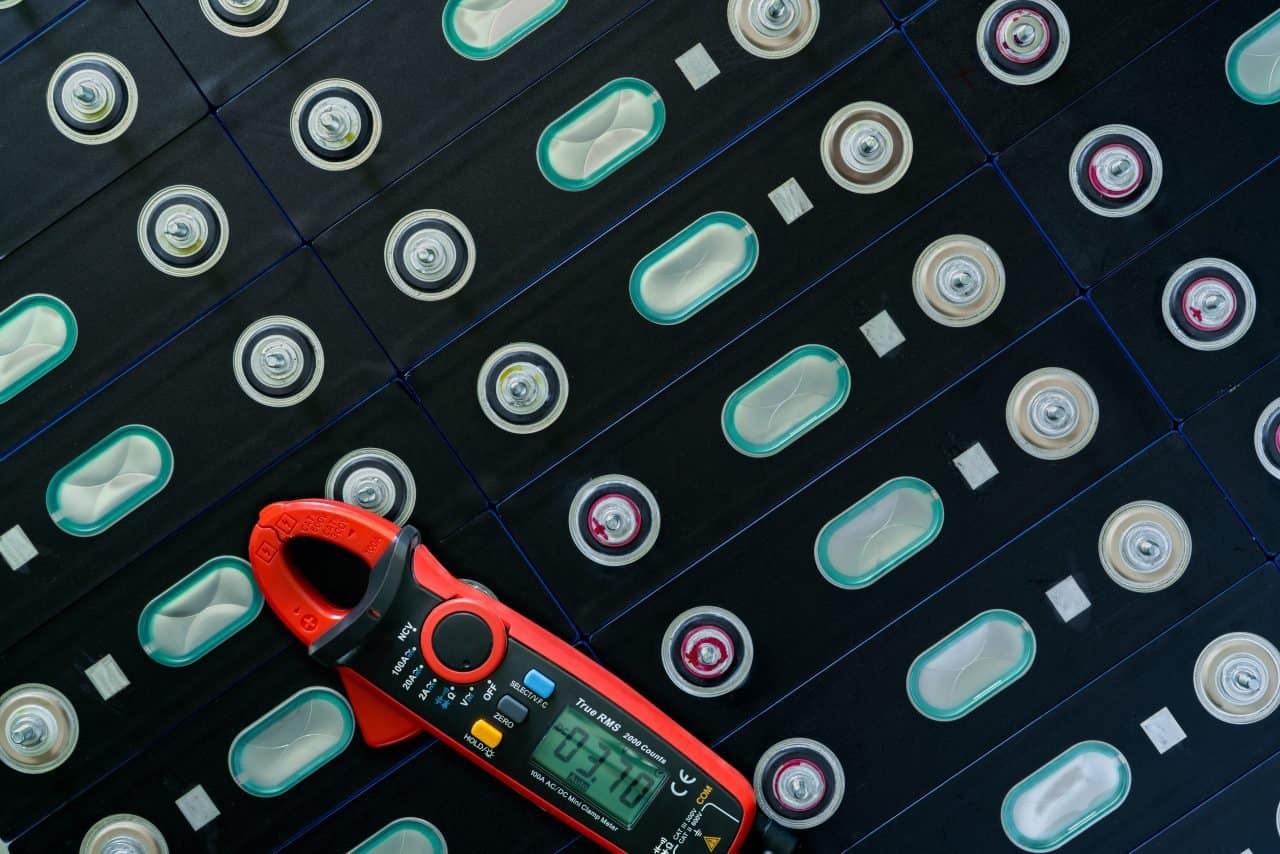

As I delve into the world of battery manufacturing in 2024, I'm amazed at how rapidly this sector is evolving.

The top battery manufacturing companies in 2024 include CATL, LG Energy Solution, Panasonic, and Tesla. These companies lead the industry through technological advancements and strategic partnerships that cater to the growing electric vehicle and renewable energy sectors.

But why do these companies dominate the market? Join me as we explore their innovative technologies, strategic market strategies, and what the future holds for them.

CATL leads the global battery market in 2024.True

CATL dominates due to high-performance batteries and strategic partnerships.

What Innovations Are Driving These Companies Forward?

Discover the groundbreaking innovations propelling leading battery manufacturers to new heights.

Innovations driving battery companies forward include solid-state technology, enhanced recycling processes, and AI-driven manufacturing techniques. These advancements improve energy density, sustainability, and production efficiency, positioning companies like CATL, LG Energy Solution, and Tesla at the industry's cutting edge.

%[A futuristic battery lab with advanced technology and robotic arms working on battery cells.]![]

Solid-State Battery Technology

Solid-state batteries represent a significant leap in battery technology1, offering higher energy density and improved safety over traditional lithium-ion batteries. Companies like Samsung and Toyota are investing heavily in this innovation, aiming to reduce costs and enhance the performance of electric vehicles (EVs).

Advanced Recycling Processes

Battery recycling is becoming increasingly important as the demand for electric vehicles rises. Leading companies such as Redwood Materials are developing advanced recycling techniques to recover valuable materials like lithium and cobalt. This not only reduces environmental impact but also lowers production costs by reusing scarce resources.

AI-Driven Manufacturing

Artificial intelligence is revolutionizing the battery manufacturing process by enhancing precision and efficiency. Companies like Tesla are utilizing AI for quality control and predictive maintenance, ensuring optimal performance and longevity of their battery products. AI-driven manufacturing solutions2 streamline operations, reduce waste, and accelerate innovation cycles.

Strategic Partnerships and Collaborations

To stay ahead, battery manufacturers are forming strategic partnerships with tech giants and automobile manufacturers. For example, LG Energy Solution collaborates with GM to develop Ultium batteries, focusing on scalability and integration into next-gen EVs. Such alliances foster knowledge exchange and resource sharing, accelerating technological advancement.

Sustainable Materials and Production Methods

Companies are increasingly exploring sustainable materials for battery production, including biodegradable electrolytes and non-toxic components. Panasonic's initiatives in using greener materials demonstrate a commitment to reducing the carbon footprint of battery manufacturing. These innovations align with global sustainability goals and enhance corporate responsibility efforts.

Solid-state batteries offer higher energy density.True

Solid-state batteries provide improved energy density over lithium-ion, enhancing EV performance.

AI-driven manufacturing decreases battery production efficiency.False

AI enhances precision and efficiency, improving rather than decreasing production efficiency.

How Do These Companies Influence the EV Market?

Battery manufacturers like CATL and Tesla are pivotal in shaping the EV landscape.

Major battery companies influence the EV market by advancing battery technology, reducing costs, and forming strategic partnerships with automotive giants. Their innovations enhance vehicle range and efficiency, directly impacting consumer adoption rates.

The Role of Technological Advancements

Battery manufacturers are continuously pushing the boundaries of what's possible in electric vehicle (EV) technology. For instance, CATL has developed the LFP batteries3 which are renowned for their safety and longevity. Such advancements have made EVs more appealing to consumers who prioritize reliability and cost-effectiveness.

Strategic Partnerships with Automotive Giants

Strategic alliances between battery manufacturers and car companies are crucial. Tesla's collaboration with Panasonic, for instance, enables significant economies of scale in battery production, making electric cars more affordable. This partnership also accelerates the transition towards renewable energy solutions in transportation.

Driving Down Costs

Economies of scale and technological improvements have led to a notable reduction in battery costs. According to recent studies, battery prices have dropped by over 80% since 2010, largely due to the efforts of leading manufacturers like LG Energy Solution. As prices continue to fall, the overall cost of EVs becomes more competitive with traditional vehicles.

Enhancing Vehicle Performance

These companies are not just reducing costs but also enhancing vehicle performance. For example, Tesla's latest batteries offer increased energy density, allowing for longer ranges on a single charge. This directly addresses range anxiety, a common concern among potential EV buyers.

Influence on Policy and Infrastructure

Moreover, battery companies wield influence beyond just product development. Their investments in research and infrastructure often guide government policies and incentives. Companies like Panasonic actively engage with policymakers to shape regulations that foster sustainable growth in the EV sector.

These combined efforts not only bolster the market for electric vehicles but also accelerate the global shift towards cleaner energy solutions.

Battery prices have dropped over 80% since 2010.True

Technological improvements and economies of scale have reduced costs.

LFP batteries are known for short lifespan and safety issues.False

LFP batteries are actually renowned for their safety and longevity.

Which Companies Are Leading in Battery Technology in the USA?

Explore the forefront of battery innovation in the USA, where companies are shaping the future of energy.

Leading companies in battery technology in the USA include Tesla, QuantumScape, and Solid Power. They excel through groundbreaking technologies and significant investment in R&D to enhance energy density and reduce costs.

Pioneers of Battery Innovation in the USA

Tesla, an undeniable leader in the electric vehicle market4, is also at the forefront of battery technology innovation. With its Gigafactories producing lithium-ion batteries, Tesla continues to enhance battery range and efficiency, pivotal for both EVs and home energy storage solutions. The company's commitment to improving battery lifespan and sustainability is unmatched.

QuantumScape is revolutionizing the industry with its solid-state battery technology. Unlike conventional lithium-ion batteries, QuantumScape's solid-state batteries promise higher energy density, faster charging times, and improved safety by eliminating liquid electrolytes. Such innovations could drastically alter the landscape of energy storage solutions.

Solid Power, another significant player, focuses on next-generation all-solid-state batteries. These batteries offer a safer, more stable alternative to current technologies and are expected to enhance vehicle performance and range significantly. Solid Power's partnerships with leading automakers underscore its influence in advancing battery tech.

Strategic Collaborations Fueling Growth

The key to success for these companies often lies in strategic partnerships and collaborations. For instance, Tesla's collaboration with Panasonic has been instrumental in advancing battery cell production capabilities, ensuring a steady supply for Tesla's expanding EV lineup. Such alliances help leverage expertise, share resources, and accelerate innovation.

Similarly, QuantumScape's partnerships with automotive giants like Volkswagen indicate a robust commitment to integrating cutting-edge battery technologies into mainstream automotive applications, promising future-ready solutions that align with the global push towards cleaner energy.

Investment in Research and Development

A core driver of innovation among these companies is their relentless investment in research and development (R&D). Tesla's significant allocation towards R&D facilitates continuous enhancements in battery performance and cost-effectiveness. Such investments are crucial for maintaining competitive advantages and addressing challenges like recycling and resource scarcity.

QuantumScape and Solid Power also prioritize R&D to refine their solid-state technologies further. Their focus on scalability and commercial viability aims to transform these advancements into practical applications, supporting the transition to sustainable energy globally.

Key Challenges and Opportunities

Despite these advancements, challenges remain. Issues such as battery recycling, supply chain sustainability, and cost reduction continue to pose hurdles. However, these challenges also present opportunities for innovation. Companies that successfully address these issues can set new industry standards and secure leadership positions in this rapidly evolving field.

Tesla leads in lithium-ion battery production in the USA.True

Tesla's Gigafactories are major producers of lithium-ion batteries.

Solid Power focuses on liquid electrolyte batteries.False

Solid Power specializes in all-solid-state batteries, not liquid ones.

What Are the Investment Opportunities in Battery Stocks?

Exploring battery stocks offers a promising avenue for investors amid the clean energy revolution.

Investment opportunities in battery stocks are bolstered by the growth of electric vehicles, renewable energy demands, and advancements in energy storage technologies. These factors drive the value of companies like CATL, LG Energy Solution, and Tesla, making them attractive options for investors seeking to capitalize on sustainable energy trends.

%[A bustling stock market scene with battery technology symbols.]

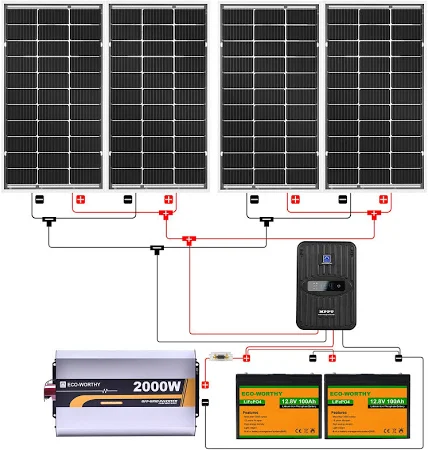

Understanding the Battery Stock Market

The battery industry is a cornerstone of the clean energy transformation, providing crucial support to sectors like electric vehicles (EVs) and renewable energy. As governments worldwide push for greener policies, the demand for efficient and long-lasting batteries is skyrocketing. This trend presents numerous investment opportunities5 in battery stocks, as companies innovate to meet this growing demand.

Battery manufacturers like CATL and LG Energy Solution are expanding their production capabilities to cater to the increasing needs of EV manufacturers. The global push for sustainable energy sources also fuels interest in energy storage solutions, positioning battery stocks as a lucrative investment.

Key Players in the Battery Stock Market

Several companies are leading the charge in the battery industry, offering robust investment opportunities:

| Company | Key Products/Services | Market Impact |

|---|---|---|

| CATL | EV batteries | Dominates with high-performance batteries |

| LG Energy Solution | Advanced energy solutions | Innovates with cutting-edge battery technologies |

| Panasonic | Lithium-ion batteries | Partners with Tesla for gigafactory production |

| Tesla | Energy storage systems | Integrates with EVs and solar energy solutions |

These companies are continuously investing in research and development to enhance their technologies, ensuring they stay ahead in this competitive market. For instance, Tesla's advancements6 in energy storage are transforming how renewable energy is harnessed and stored.

Factors to Consider Before Investing

-

Technological Advancements: Stay informed about breakthroughs in battery technology, such as solid-state batteries, which promise higher energy densities and faster charging times.

-

Partnerships and Collaborations: Evaluate how strategic alliances, like those between car manufacturers and battery producers, can enhance a company's market position.

-

Government Policies: Monitor regulations and incentives related to clean energy adoption, as these can significantly impact the demand for battery technologies.

Investors should consider these aspects when evaluating potential investments in battery stocks to ensure they align with both market trends and sustainability goals.

Battery stocks are driven by the EV market growth.True

The increasing demand for electric vehicles boosts battery stock investments.

CATL is not a major player in the battery market.False

CATL is a leading company in the EV battery sector, dominating globally.

TOWO Power Is a leader for lithium battery solution company from China

Conclusion

The leading battery manufacturers of 2024 are pivotal in shaping our energy future. Their innovations define current trends while paving the way for sustainable solutions in transportation and beyond. Let's keep an eye on these players for both their impact and investment potential.

-

Explore breakthroughs in solid-state technology for future-ready battery solutions.: Proponents say they offer safer, cheaper and more powerful batteries for electric vehicles (EVs), as well as faster charging times. There could ... ↩

-

Discover how AI optimizes battery production for efficiency and precision.: By capturing higher dimensional relationships from battery data gathered from driving tests and other physical tests, AI can better inform battery designers on ... ↩

-

Learn about LFP batteries' benefits for EV safety and longevity.: An LFP battery is a type of lithium-ion battery known for its added safety features, high energy density, and extended life span. ↩

-

Discover Tesla's strategic approach to dominating the EV market.: The four Ps, Product, Price, Place, and Promotion, make up the marketing mix, which aids in growth. To preserve the most earnings possible from ... ↩

-

Explore detailed insights on emerging battery stock investment trends.: Battery stocks haven't fared well for much of 2024, but a big rally has put them back in the spotlight. The Global X Lithium & Battery Tech ETF ... ↩

-

Discover how Tesla is revolutionizing energy storage technologies.: “It won't be long” before Tesla's stationary energy storage business is shipping 100GWh a year, CEO Elon Musk has claimed. ↩